myAccount Guide

Overview of myAccount

myAccount is a single access point for all Revenue’s secure online services. It is the quickest, easiest and most convenient way for you to manage your tax affairs. The services provided include items such as:

- Manage your tax record

- Claim tax credits, including relief for health expenses

- Declare additional income

- Submit a return of income (Form 12)

- View or request an end of year statement (P21)

- Register a new job or pension

- Pay Local Property Tax

- View your PAYE correspondence such as P45, P60

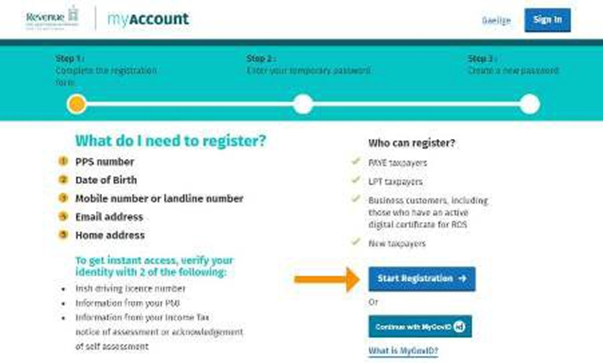

What you need to register for myAccount:

- Personal Public Service Number (PPSN)

- Date of birth

- Phone number (mobile or landline)

- Email address

- Home address

You can get instant access to MyAccount if you can verify your identity with two of the following:

- Irish driving license number

- Information from your Form P60

- Information about your Income Tax

- Notice of assessment or acknowledgement of self-assessment from Revenue

If you cannot provide this information, please select the ‘by post’ option and Revenue will issue your password within 10 working days.

Registering for myAccount:

Revenue has designed the registration process to be easy as possible to use. Please see below screenshot of the registration page.

Visit https://www.ros.ie/myaccount-web/ to access the registration homepage. Click on the “Start Registration” button to begin. You will be asked for a number of details such as PPSN, Name, DOB, Address, Telephone Number, Email, Proof of Identity documentation.

If the details match those on record you will be issued with a temporary password either by text, email or post. Once you have your temporary password, you are ready to use myAccount.

Please note that the temporary password if only valid for a certain period of time

- Text or email – expires after 1 hour

- Post – expires 21 days from the date of the letter

You will have to create a new password when you log in to myAccount for the first time. Please keep your password safe and secure.

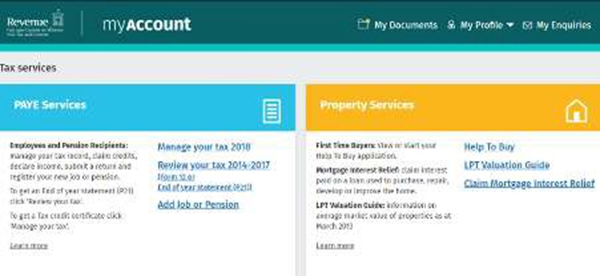

Adding a Job or Pension

Once logged into myAccount click on the “Add Job or Pension” link under the PAYE Services section

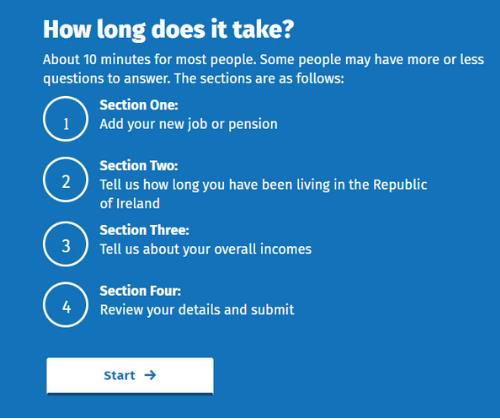

The process can take up to 10 minutes. Some people may have more or less questions to answer. The sections are outlined below. Click on the “start” button to begin.

You should now have successfully setup your job record with Revenue. If you have multiple employments they can be added by repeating the above steps again.

MyAccount Benefits

Employees will have the most accurate, up to date information relating to pay and statutory payroll. This will ensure the correct amounts of Income Tax (PAYE), Pay Related Social Insurance (PRSI), Universal Social Charge (USC) and Local Property Tax (LPT) are deducted. This will improve the accuracy, ease of understanding and transparency of the PAYE system. Revenue have used the term SMART PAYE to online the benefits to you.

Simplified online services Maximise use of entitlements Automatic end of year review Real time accurate data Transparency

For more on Payroll Legislation and MyAccount read:

Paycheck Plus, Your Outsourced Payroll Provider

Paycheck Plus is an award-winning payroll company that specialises in UK and Irish payroll outsourcing. With industry-leading accuracy levels our affordable payroll service provides outsourced payroll services to organisations of all sizes.

Our ISO accredited payroll firm offers a range of payroll services which ensure payroll accuracy, while our bespoke payroll software lets you consolidate your payroll processes into one simple and efficient workflow.

For more information simply request a payroll quote or call +353 (0) 1 905 9400.